Creative Capital for Commercial Real Estate

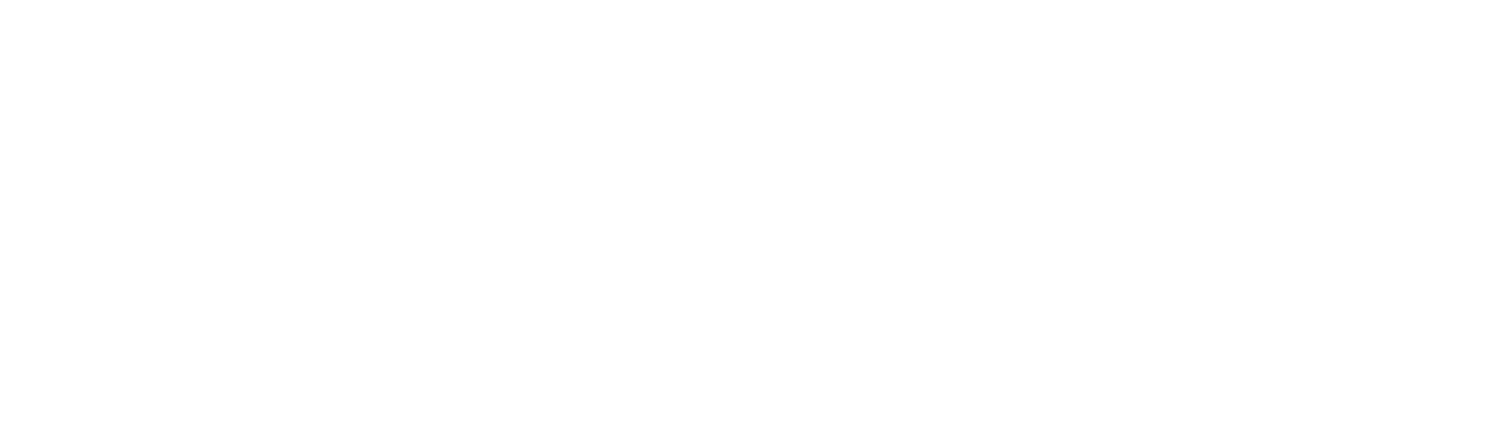

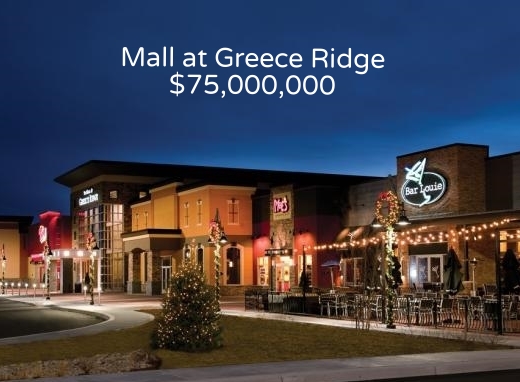

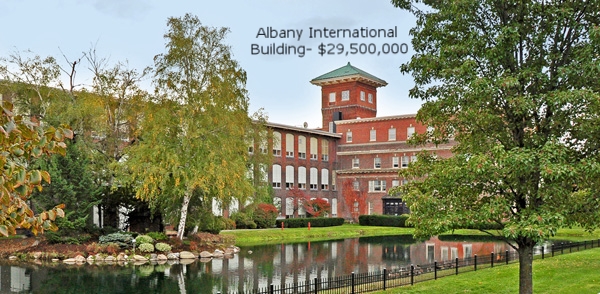

Recent Deals

About Our Firm

We arrange loans, equity, and mezzanine investments for all types of commercial real estate including multifamily, hospitality, student housing, offices, industrial, retail, self-storage, condominium conversion, redevelopment, and all types of healthcare facilities.

We also arrange structured and construction loans, including loans with layers of mezzanine or preferred equity financing. In some instances, we have arranged between 96% and 100% of the debt and equity required for purchases. Our projects range from newly constructed hotels to transitional or “out of the box” assets. We also obtain debt and equity for hard to place fundings, such as turnaround or repositioned properties. Our typical loan size averages $15 million, although we are able to obtain funding for any loan in excess of $1,500,000 and have arranged loans in excess of $100,000,000.

Our expertise is in evaluating the problems with a loan request and creating solutions to what may seem to be insurmountable issues, and to stretching the ability of investors and lenders to reach maximum investments or loan proceeds.

Capital & Venture Resources has offices in Connecticut, New York, New Jersey and Massachusetts.

Newsletter & Sign Up

Dear Friend,

We are thrilled to announce another closing, a $29,177,000 loan for a multifamily property, just outside of Albany, NY. The building on the property was an adaptive reuse of a historic commercial property into a thriving multifamily property and included the utilization of historic tax credits. We also obtained the construction financing and the loan amount was well in excess of the construction loan.

Our customer wanted a flexible exit, the longest period of interest only possible, an 80% LTV and needed to use a short period of stabilized occupancy to size the loan. We accomplished all those goals despite...

For full article click here